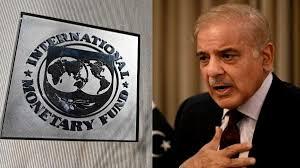

IMF Bailout Pakistan: Breaking Free from a Dangerous Cycle

Pakistan finds itself once again at the doorstep of the International Monetary Fund, negotiating for urgent financial support to prevent an economic collapse. The latest IMF bailout Pakistan package is not just about bridging a fiscal gap—it reflects deeper structural issues that the country has repeatedly failed to address. Inflation, currency devaluation, and growing debt have cornered the economy, prompting another cycle of external dependency.

A Pattern of Dependency

This is not the first time Pakistan has sought IMF assistance. Over the decades, the country has returned to the IMF more than twenty times, reflecting a pattern of quick fixes over lasting reforms. The IMF loan to Pakistan 2025 is expected to come with strict conditions: cuts to subsidies, broader tax reforms, and changes in monetary policy. But history shows that once the immediate crisis passes, reform momentum often stalls. The current bailout offers a chance to break that cycle—if Pakistan can seize it.

Conditions with a Purpose

Unlike previous programs, the new package emphasizes transparency and long-term reform. The IMF is pushing for improved tax compliance, reduction of losses from state-owned enterprises, and realistic energy pricing. These measures are aimed at reducing fiscal leakage and restoring investor confidence. The IMF loan to Pakistan 2025 will also require digital tracking of public spending and better oversight of foreign exchange reserves. These reforms are vital not just to satisfy lenders, but to rebuild the foundations of Pakistan’s economy.

A Test of Political Will

Economic recovery won’t depend solely on financial aid—it requires political courage. Implementing unpopular measures, such as energy price hikes or subsidy reductions, will be politically risky, especially in a country where public trust in institutions is already low. But without these tough decisions, even the IMF loan to Pakistan 2025 will offer only temporary relief. The real test lies in whether Pakistan’s leadership can stay the course and make reform irreversible.

Conclusion

The IMF bailout Pakistan effort in 2025 could be either a turning point or just another chapter in a long story of dependency. It brings with it an opportunity—a chance to rebuild trust, strengthen the economy, and reduce the need for future bailouts. But success will depend not on the amount loaned, but on the quality and sincerity of reforms implemented. Pakistan stands at a crossroads: it can either break free from this cycle or risk being trapped in it again.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness